PEO 2.0 - The Era of Cognition has Arrived

By Paul Cataldo

Cognition: The mental action or process of acquiring knowledge and understanding through thought, experience, and the senses.

Digital disruption has transformed the way businesses operate. Consider this: The world’s largest retailer has no physical stores, the world’s largest hotelier owns no hotels, and the world’s largest taxi company owns no cabs. Amazon, Airbnb, and Uber have all disrupted their respective industries. Looking back, the level of disruption resulting from the recent wave of digital transformation is truly astounding.

As each industry has digitally transformed, it has generated an enormous treasure trove of data assets. A 2018 Forbes articles stated that 90 percent of the world’s data had been created in the previous two years.

THE ERA OF THE COGNITIVE ENTERPRISE HAS ARRIVED

MIT professor Jeanne Ross proclaims the next wave of transformation as more enterprises adopt and embrace artificial intelligence to power their businesses. By the way, the three industries cited above have now become artificial intelligence (AI)-driven, or cognitive enterprises.

PEOs that are adopting AI are becoming cognitive enterprises too, and are reaping benefits with more intelligent decision-making, realizing paybacks never before possible.

PEOs and insurance organizations are integrating AI and leveraging their data to:

- Deliver a better customer experience;

- Gain a competitive advantage in their respective markets;

- Reduce quote turnaround times;

- Evaluate risk more accurately to reduce loss ratios; and

- Manage claims more effectively to reduce claim duration and expenses.

WHAT IS AI & HOW CAN IT BENEFIT YOUR ORGANIZATION?

Before we dive into how AI will create PEO 2.0, the PEO of the future, let’s look at what AI is and how it can benefit your organization. The computer science school of MIT breaks AI down into three main branches: Machine learning (ML), robotics, and natural language processing.

While all these branches are relevant to PEOs, I will mainly focus on the benefits of machine learning. Its value is in its ability to discover and surface important patterns and relationships residing in the vast amount of data that businesses collect every day.

ML uses computer algorithms to learn from real-world data samples and then improves itself without needing any human intervention. If you have a Netflix or Spotify account, you have seen the power of ML in action when recommendations are made for you. All recommendations are based on your (and others) historical data, which improves your user experience automatically with personalized recommendations.

ML models learn from real-world outcomes by minimizing the error between what they predict and what the real-world outcome is. ML tunes the models or algorithms over many training sessions seeking to minimize this error—this is essentially the learning process.

Many PEOs are using AI applications to price more accurately, reduce loss ratios, and reduce quote turnaround times.

AI-ENABLED EVALUATION: AN EXAMPLE

A PEO wants to evaluate the risk for a specific employee group. Several features or variables in the group can impact risk, including age, prescription history, morbidity, demographics, location, and other group characteristics. What makes ML powerful is that models can consider 70, 80, or even 100 or more features to predict the risk of a group. An ML model could use the above features and add aggregate/anonymous medical data to get a more complete picture of risk.

To “train the model” for this PEO, millions of real-world observations with these features can be used to assess how much risk a particular policy represents. Think about how leveraging this extensive volume of data improves pricing accuracy. Even the most experienced evaluators have likely processed no more than 10 thousand policies in their lifetimes and most likely only consider at most 10 to 15 features at a time. These models are not intended to replace evaluators, but are powerful tools that enable them to combine their art with science to make sharper and more informed decisions.

More importantly, once a model has been trained it can make a predicted risk assessment almost instantaneously. The PEO can then use this risk assessment to develop more accurate models for evaluating its client base.

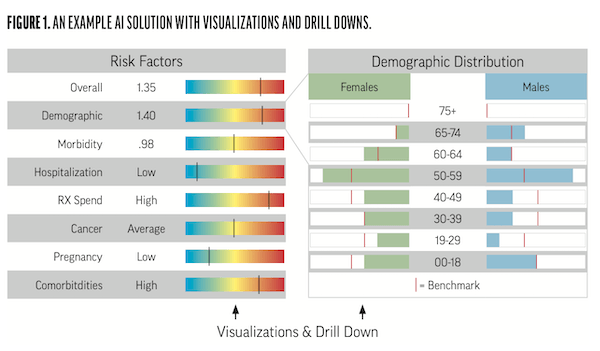

ML solutions provide more insight into groups you are evaluating. Figure 1 shows a simplified example from an AI solution that helps predict the risk of a group and enables you to drill down to better understand the specific drivers of risk. This application combines ML with enhanced data assets, enabling you to obtain a richer picture of risk.

You can see how various elements are impacting a group’s health risk, such as cancer, morbidity, and demographic risks, with the ability to drill into a specific risk factor to better understand what may be driving that risk up or down.

PEOs embracing this type of AI-based assessment solution have seen their loss ratios improve by 10 to 15 percent in their first three years of production. Of course, this can’t be guaranteed for every PEO, but the results have been consistent and significant for those organizations that have implemented AI/ML into their evaluation operations.

THE ROAD TO AI TRANSFORMATION TODAY

The examples discussed in this article showcase the power and benefits of AI and ML. Ram Charan, world renowned business guru, advisor, and author on AI, speaking on machine learning stated, “Any organization that is not a math house now, or is unable to become one soon, is already a legacy company.”

This speaks to the coming wave of what I call the cognitive transformation of business by AI. As with the recent digital transformation, sitting on the sidelines and waiting to see what happens is not a prudent option. Fortunately, you can start small on the AI road to transformation and build on your early learnings. I believe that early movers will gain an enduring advantage.

PAUL CATALDO

Chief Marketing Officer

Gradient AI

Boston, Massachusetts

This article appeared first on NAPEO.