CCMSI Saves Employers $300 Million in Workers’ Compensation Claims with AI

March 9, 2023

By Gia Sawko

Gradient AI’s claims solution enables teams to triage claims proactively by automatically predicting the risk level of new and existing claims.

Cannon Cochran Management Services, Inc. (CCMSI) is the largest independent third-party administrator (TPA) in the United States, providing innovative risk management solutions to thousands of companies. From the moment CCMSI opens a claim, it works toward a successful close. That’s because it views every open claim as an open door to costs that can quickly get out of control. CCSMI’s focus on innovation and its deep level of claims experience have led to a solid reputation for significant claim reductions with a positive impact on aged-loss portfolios and the management of new claims.

An early adopter of artificial intelligence (AI), the company developed an AI-driven intervention model that flags at-risk claims for adjusters. As its AI initiative grew, CCMSI turned to Gradient AI for a solution that could provide both the claims administration team and their clients with up-to-the-minute information and cost estimates based on the most recent claims information.

AI Becomes MVP Against Converging Industry Challenges

As part of its quest to get injured workers back to work quickly, CCMSI continually focuses on improving its claims process, and with good reason. According to a recent EY survey, 87% of customers say effective claims processing is one of the most important insurance operations. However, until recently, many insurance companies handled claims processing tasks manually, resulting in too much time, labor, and money spent on the process. Both employers and injured workers want workers’ compensation claims to be resolved quickly and accurately so that the worker can return to work as soon as possible. If they don’t get the appropriate level of service, employers may move on to a new insurer.

In addition to claims process inefficiencies, many insurers are grappling with the talent gap brought on by a rapidly aging and retiring workforce. According to the U.S. Bureau of Labor Statistics, 50% of the current insurance workforce will retire in the next 15 years, leaving more than 400,000 open positions unfilled.

Building an AI-Driven Claims Solution

As part of its claims enhancement program, CCMSI first studied the impact of co-morbidity factors on claims. The company soon realized that this alone added an entirely new level of claims analysis complexity. Additionally, CCMSI realized that many other factors, captured in the adjusters’ notes, also had an impact on claims but could not be mined for valuable information.

CCMSI set out to address these issues by expanding its system’s data fields to track almost 80 additional claim elements to leverage the predictive value of this additional data to resolve claims sooner. These new fields allowed CCMSI’s adjusters to capture and quantify a variety of other factors such as a claimant’s mood during a conversation, enthusiasm for returning to work, and punctuality at an appointment, among other elements related to the claimant’s case.

CCMSI turned to Gradient AI, a leading provider of proven AI solutions for the insurance industry, to leverage the value of this data with the goal of improving claims processing speed and accuracy. Using the data elements above, algorithms score each claim as high, medium, or low risk. The model then uses the data to assist adjusters, supervisors, and clients in managing claims and improving communications.

Gradient AI’s claims solution enables teams to triage claims proactively by automatically predicting the risk level of new and existing claims. The solution not only learns from an insurance company’s own data but from a high-resolution federated database with tens of millions of observations and ten times (10x) the features of traditional legacy assessment processes. Furthermore, Gradient AI’s solution leverages Natural Language Processing to extract valuable insights from adjusters’ notes.

WITH GRADIENT AI, CCMSI QUICKLY ADDRESSES CLAIMS WITH HIGHER POTENTIAL SEVERITY, ENSURING APPROPRIATE CARE FOR INJURED WORKERS WHILE BETTER MANAGING COSTS AND REDUCING RISK FOR THE COMPANY’S CLIENTS.

CCMSI’s claims system notifies adjusters and supervisors early in the life of a claim of potential injury severity and presents them with a claim risk profile. Adjusters can make referrals for additional services, adjust reserves, notify the client, or take other actions. Injured employees can now return to work more quickly, minimizing serious onsite disruptions and economic impact on the company.

AI Saves CCMSI Clients $300 Million

Gradient AI has helped CCMSI reduce workers’ compensation claims costs by about 10%, resulting in savings of more than $300 million in savings for its clients. These findings were verified by an independent study, which conducted an analysis of indemnity claims over a six-year period.

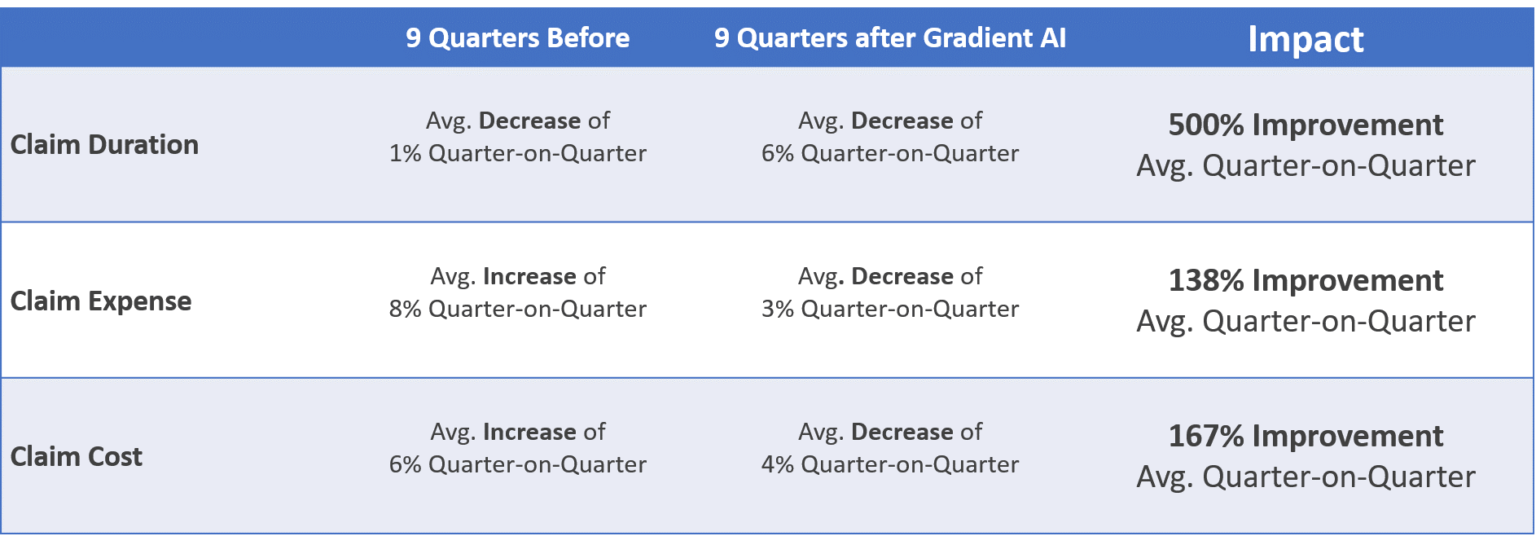

The table below summarizes the positive results that CCMSI achieved by leveraging Gradient AI in its operations:

In the future, CCMSI anticipates improving the quality of projections and reducing the severity and duration of claims events for clients and their employees.

“We are realizing tremendous value from integrating our AI claims models into the Gradient AI solution,” said Skip Brechtel, executive vice president, of CCMSI. “As a TPA, a key goal is to support and deliver exceptional value to our clients. By investing in innovative technology, we’ve been able to improve the claims journey for our customers. And our clients are thrilled with the results because of the increased capacity to triage incoming claims, decrease processing times and reduce the costs of claims.”

AI will continue to be a key enabler in the workers’ comp insurance industry. The challenges of mitigating employee attrition, defending against intensifying competition, and maintaining a healthy bottom line despite increasing pressures on profitability can all be addressed through the use of AI. CCMSI is leading the industry in embracing AI to meet the challenges of claims management today and into the future.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!

Gia has 30 years of experience in the Property Casualty Claims Industry. As Gradient AI’s Senior Product Manager of Claims, Gia leads product development for its claims management solution leveraging AI and machine learning to drive better outcomes for claim operations. Her passion and focus are empowering adjusters with the benefits of machine learning to reduce claim duration, and cost and improve operational efficiency. Gia’s career started in Personal Auto but also includes Commercial Auto, Commercial Liability, and Workers' Compensation as an adjuster and supervisor. She has also served as Whole Foods Market’s Managing Director of Safety, Claims, and IBNR. This unique opportunity gave Gia a powerful trio of skills including loss prevention, risk management, and claim financials. Following a successful career at Whole Foods, Gia spearheaded solution development as Vice President of Business Impact at Gallagher Bassett leveraging her unique skills to drive business value from technology and artificial intelligence.

This article appeared first on AI Tech Park.